#How to Find Forex Trading Signals

Explore tagged Tumblr posts

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Text

WindealAgency.com review:Account Types

Choosing a forex broker is never just about flashy websites or bold promises—it's about trust, regulation, and real trader experiences. In this review, we’ll take a close look at WindealAgency.com review and analyze whether it stands up as a reliable broker or raises red flags.

We’ll examine everything from its licensing, user feedback, and account types to deposit methods and trading conditions. A legitimate broker should check all the right boxes—so does WindealAgency.com reviews meet the standard? Let’s find out.

Account Types at WindealAgency.com: A Deep Dive into Their Offerings

When it comes to trading, flexibility and tailored experiences matter. WindealAgency.com reviews understands this well, offering a structured yet diverse range of account types to accommodate traders of all levels. Let's break down what they provide:

Account Type

Minimum Deposit

Bronze

$10,000

Silver

$25,000

Gold

$50,000

Premium

$100,000

Platinum

$250,000

VIP

$500,000

VIP+

$1,000,000

What Do These Accounts Mean for Traders?

At first glance, the minimum deposits might seem high, but let's analyze this setup. A structured tier system like this often indicates a serious brokerage catering to mid-to-high-level traders. Brokers that deal with professional clients or institutions usually set their entry points higher to ensure quality service, tight spreads, and dedicated support.

Bronze & Silver – These tiers are suitable for traders looking to get a professional-grade experience without committing massive funds upfront. Usually, accounts in this range come with basic perks like educational resources, standard spreads, and decent customer support.

Gold & Premium – Here, things start getting more advanced. Higher-tier accounts often mean lower spreads, priority support, and access to better trading conditions. This could include exclusive trading signals, personal account managers, or even faster withdrawal processing.

Platinum & VIP – At this level, traders are likely to receive premium analytics, risk management tools, and possibly even invitations to exclusive trading events. These accounts are for serious investors who demand top-tier trading conditions.

VIP+ – A $1,000,000 minimum deposit is an elite-level requirement. Brokers that offer this tier typically cater to institutional traders, hedge funds, or ultra-high-net-worth individuals. Expect customized trading conditions, personal analysts, and direct access to liquidity providers.

What Does This Tell Us About WindealAgency.com?

This tiered approach signals a brokerage that is not just catering to casual retail traders but instead positioning itself as a high-end trading platform. While the minimum deposit thresholds are significantly higher than entry-level brokers, this could also indicate a focus on serious traders who want quality execution, security, and premium service.

Would this account structure work for every trader? Maybe not. But for those looking for a premium brokerage experience, WindealAgency.com reviews seems to have a well-designed system in place.

How the Domain Purchase Date Confirms WindealAgency.com’s Legitimacy

One of the easiest ways to check a broker’s credibility is by looking at the relationship between its establishment date and the domain purchase date. Why does this matter? Because when a company secures its online presence before officially launching, it’s a sign of long-term planning and serious business intentions.

For WindealAgency.com review, we see that:

The brand was established in 2021

The domain was purchased on November 19, 2020

This means that WindealAgency.com reviews secured its domain before launching its services. That’s a great indicator of proper business structuring rather than a hastily thrown-together website. Many unreliable brokers often register their domain after they start operating, which raises red flags about their long-term commitment.

Think about it: a broker that purchases a domain in advance is likely investing in its infrastructure, platform, and compliance efforts before accepting traders' funds. This adds another layer of reassurance for clients looking for a trustworthy broker.

All in all, this timeline makes sense and aligns with what we expect from a legitimate brokerage.

Trustpilot Reviews: A Strong Indicator of WindealAgency.com’s Reliability

One of the best ways to gauge a broker's reputation is by looking at what real traders say about it. In the case of WindealAgency.com review, the Trustpilot score stands at 4.3, which is quite solid for a trading platform.

Now, let’s break it down further:

Total reviews: 24

Positive reviews (4-5 stars): 23

That means almost all traders who left reviews had a positive experience—an impressive ratio. In the forex industry, where brokers often receive mixed feedback due to the nature of trading, a 4.3 rating is a sign of consistent service, smooth transactions, and overall trustworthiness.

But here’s where it gets interesting. A low review count can sometimes raise questions, but the fact that 23 out of 24 reviews are positive suggests that the broker’s clients are genuinely satisfied. If there were major issues like withdrawal problems, platform failures, or shady practices, we would expect to see a much lower rating and a higher percentage of negative reviews.

Regulation & Licensing: A Key Factor in WindealAgency.com’s Legitimacy

One of the strongest indicators of a broker’s trustworthiness is its regulatory status. WindealAgency.com review operates under the FCA (Financial Conduct Authority), which is known as one of the most respected financial regulators in the world.

Now, why is this important?

The FCA is a high-authority regulator, meaning brokers under its supervision must adhere to strict financial and operational guidelines.

It enforces transparency, fund protection, and fair trading practices, ensuring that traders are not exposed to fraudulent activities.

Brokers regulated by the FCA must separate client funds from company funds, reducing the risk of financial mishandling.

Some brokers operate under weak or offshore regulations, which often make it difficult for traders to recover funds in case of disputes. But WindealAgency.com being under the FCA umbrella automatically puts it in a category of trusted financial institutions.

So, what does this tell us? If a broker has gone through the rigorous FCA licensing process, it’s not a fly-by-night operation. Instead, it’s a platform that prioritizes legal compliance and trader security—two things that matter the most in the forex industry.

Is WindealAgency.com review a Legitimate Broker?

After carefully analyzing all the key aspects of WindealAgency.com reviews, the picture looks quite clear. This broker checks all the major boxes of legitimacy, making it a strong contender in the forex trading industry.

Regulation & Security: Being FCA-regulated, WindealAgency.com review operates under one of the strictest financial authorities, ensuring fund protection and transparency—a huge green flag.

Domain & Establishment: The fact that they secured their domain before launching the brand speaks volumes about their long-term vision and professionalism.

User Reviews: A 4.3 Trustpilot rating with an overwhelmingly positive response from traders indicates that real users have had a good experience.

Account Types: The structured tier system suggests that this broker caters to serious traders who value premium conditions and a high-end trading experience.

Looking at these factors, we think WindealAgency.com reviews can be trusted. It’s not just another unregulated, short-lived broker—it has the credentials, the reviews, and the structure of a serious financial platform.

7 notes

·

View notes

Text

What Is Forex? The Wild World of Currency Trading

Ever felt that rush when you drop a few coins into a gumball machine, anxiously waiting to see what color you’ll get? Welcome to the thrilling realm of Forex trading—a universe where speculation and strategy collide like Deadpool and a bad guy in a dark alley. So, buckle up and grab your favorite chimichanga; let’s jump into the vibrant, chaotic world of Forex!

What the Heck Is Forex?

Alright, folks, let’s get down to brass tacks (or, you know, shiny copper coins). Forex, or foreign exchange, is the largest financial market in the world. Yeah, even bigger than that stash of Yu-Gi-Oh cards you used to have! Here’s the scoop: Forex is where currencies are traded 24 hours a day, five days a week. Picture a never-ending marketplace with traders from every corner of the globe, shouting and signaling—kinda like a bazaar but with less camel and more currencies.

In a nutshell, Forex allows you to swap one currency for another. Think of it as a super-powered financial bartering system, only instead of trading goats or magic rocks, we’re dealing with dollars, euros, and yen. You buy one currency while simultaneously selling another. Easy peasy, right? Well, sort of!

Why Trade Forex? Is It Worth It?

1. Market Liquidity? Heck Yeah!

Imagine a party where everyone’s invited—except the awkward guy who talks about birdwatching. Forex has over $6 trillion (yes, trillion with a “t”) traded every single day. That means you can buy or sell almost any currency almost whenever you want. No waiting for your crypto buddy to finish updating his meme stock portfolio!

2. Leverage: The Double-Edged Sword

In Forex, leverage means you're trading with borrowed funds, allowing you to control larger positions than you could otherwise afford. It sounds epic, right? But let me warn you, with great power comes great responsibility! Use leverage wisely, or you might find yourself sliding down the wrong side of “Oops! I lost all my money!”

3. Trade Anytime, Anywhere!

Thanks to the magic of the internet (and a little help from our good friends, computers), Forex is open 24/5! You can trade from your couch, at the park, or even in a taco truck line. The world’s your oyster—or, should I say, your market!

4. Diversify That Portfolio

Bored of your usual stocks? Throw in some Forex action! Currency trading provides a fantastic opportunity to diversify your investment portfolio. After all, you wouldn’t just eat one flavor of ice cream, would you? (If you said yes, I question your life decisions!)

Basic Terminology: Don’t Get Left Behind!

1. Currency Pairs: The Dynamic Duo

In Forex, currencies are traded in pairs—like Batman and Robin, or peanut butter and jelly. Each pair consists of a base currency and a quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base, and the US dollar (USD) is the quote. When you see this pair, you're essentially asking, “How much is one euro worth in dollars?”

2. Pips: Not the Pizza Kind!

A pip is a unit of measurement used to express changes in currency pairs. It's usually the fourth decimal place of a currency pair. For instance, if EUR/USD moves from 1.2000 to 1.2001, that's one pip. Think of it as a tiny frog hopping along the trading path.

3. Spread: The Cost of Admission

Ah, the spread—what you pay (or “lose”) to enter the Forex market. The spread is the difference between the buying and selling price of a currency pair. It's like paying a cover charge at a bar before enjoying the nightlife—except this bar might leave you screaming for mercy!

Getting Started in Forex: Your Fighting Chance

1. Find a Broker, Your Trusted Sidekick

To trade Forex, you need a broker. This savvy partner will help you execute trades and manage your account. Shop around for one that’s reputable, reliable, and offers an easy-to-use platform. Look for reviews; even Batman has a few bad reviews on Yelp, right?

2. Open a Demo Account: Practice Makes Perfect!

Before you throw your money into the trading pit like a seasoned gladiator, give a demo account a whirl! Most brokers offer these accounts for free to help you practice and sharpen your key trading skills. Learn how to read charts, implement strategies, and most importantly, NOT cry when you lose money!

3. Learn the Strategies: Boring, But Necessary

Whether you’re a day trader or prefer long-term strategies, learning the ropes is crucial! You wouldn't jump into battle without your sword (or at least some cool katanas), right? Read up on technical analysis, fundamental analysis, and sentiment analysis. It may sound like a snooze-fest, but trust me, it'll save you from tossing your hard-earned cash out the window.

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Conclusion: Welcome to the Revolution!

So there you have it, folks! Forex is not just some mystical realm meant for Wall Street wolves; it's a playground for the everyday hero (or anti-hero, depending on your style!). With its liquidity, 24/5 accessibility, and potential for profit, Forex offers opportunities for everyone willing to learn and adapt.

Now that you've got a taste of the extensive world of Forex, go out there and get your feet wet (but don’t literally go to a puddle and start yelling, “I’m a Forex trader!”). Master the tips, tricks, and tools, and who knows? You might just come to slay in this game! Just remember: Stay smart, stay bold, and never forget to stock up on those delicious chimichangas!

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

5 notes

·

View notes

Text

How can I get Forex XAUUSD signals?

When choosing a signal provider, consider these key factors to ensure reliability and efficiency, especially for trading XAUUSD:

Reputation: Look for a provider with a strong reputation. SureShotFX boasts an impressive TrustPilot rating of 4.3 for its exceptional XAUUSD signals.

Credibility: Trust is crucial in Forex trading. SureShotFX demonstrates its credibility with a proven track record, regulatory compliance, and transparency about signal performance. Check out their Forex Signals Performance page for past VIP signals and client feedback.

Expertise: Ensure the provider has experienced professionals. SureShotFX has a team with 9 years of trading experience, offering insights and signals compatible with TradingView XAUUSD charts.

Accuracy: Accuracy is vital in the volatile XAUUSD market.SureShotFX achieves up to 85% accuracy with a weekly target of 500–1000 pips, providing timely signals to maximize trading opportunities.

Transparency: A reliable provider should showcase performance results. SureShotFX consistently shares weekly performance metrics on their free channel, ensuring transparency.

By considering these factors, you can find a trustworthy XAUUSD signals Telegram group that meets your trading needs.

3 notes

·

View notes

Text

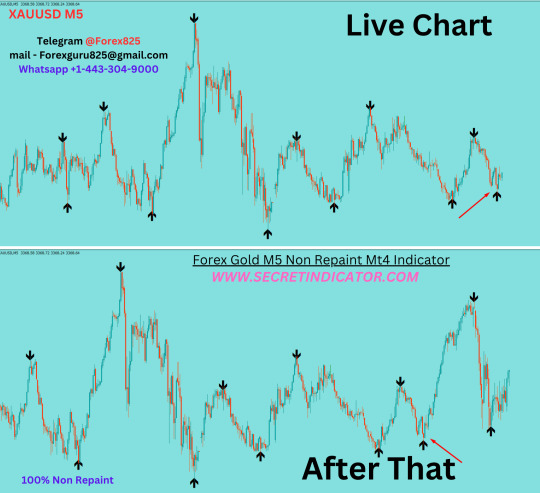

good indicators for forex trading

📊 Good Indicators for Forex Trading: The Ultimate Guide for Profitable Trades

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

✅ Introduction

Forex trading is both an art and a science. While price action and market psychology play key roles, technical indicators help traders make objective, data-driven decisions. Whether you’re a beginner or an experienced trader, choosing the right indicators can dramatically improve your entries, exits, risk management, and profitability.

But with hundreds of forex indicators available — from the classic moving averages to exotic custom tools — how do you know which ones truly work?

This detailed article explores:

What forex indicators do

The core types of indicators

The best and most commonly used indicators

How to use them effectively in combination

Common mistakes and tips for better results

📌 Table of Contents

What Are Forex Indicators?

Types of Technical Indicators

Why Indicators Matter in Forex Trading

The Top 10 Good Indicators for Forex

Deep Dive into the Most Effective Indicators

Best Indicator Combinations

Tips for Using Indicators Effectively

Common Mistakes to Avoid

How to Backtest and Optimize Indicators

Final Thoughts

1. 📉 What Are Forex Indicators?

Forex indicators are mathematical calculations based on price, volume, or open interest. They analyze past market data to help traders make predictions about future price movements. Indicators are typically plotted on or below a chart and can signal:

Trend direction

Reversal zones

Entry/exit points

Market strength

Volatility

Overbought/oversold levels

They don't predict the future perfectly, but when used correctly, they help you make probability-based decisions.

2. 📊 Types of Technical Indicators

Forex indicators fall into several major categories:

🔹 Trend Indicators

Identify the direction and strength of market trends.

Examples: Moving Averages, MACD, ADX, Ichimoku Cloud

🔹 Momentum Indicators

Measure the speed of price movement to find overbought/oversold areas.

Examples: RSI, Stochastic Oscillator, CCI

🔹 Volatility Indicators

Measure the rate of price fluctuations, showing when the market is quiet or explosive.

Examples: Bollinger Bands, ATR (Average True Range)

🔹 Volume Indicators

Gauge trading volume, often used to confirm the validity of price moves.

Examples: OBV, Volume Oscillator, Chaikin Money Flow

🔹 Custom or Composite Indicators

Combine multiple tools or custom formulas.

Examples: TDI (Traders Dynamic Index), Supertrend, Pivot Point Indicator

Each type has a purpose. Great trading strategies usually combine 2–3 different types.

3. 🧠 Why Indicators Matter in Forex Trading

Trading without indicators is like driving without a speedometer or GPS — possible, but risky and uncertain.

Good indicators help:

Define trading rules

Add objectivity to decision-making

Reduce emotional trading

Confirm entries and exits

Prevent overtrading in choppy markets

Identify trends early or avoid weak ones

They don’t guarantee success — but they increase your statistical edge.

4. ✅ The Top 10 Good Indicators for Forex Trading

Here are ten indicators that are time-tested, effective, and widely used by traders across all levels: RankIndicatorTypeUse Case1Moving Averages (EMA/SMA)TrendIdentify direction and smooth price2Relative Strength Index (RSI)MomentumSpot overbought/oversold areas3MACDTrend/MomentumSignal trend changes via crossovers4Bollinger BandsVolatilityBreakout signals, range bounds5ADXTrend StrengthMeasure trend strength (not direction)6Stochastic OscillatorMomentumShort-term reversal entries7ATRVolatilitySet dynamic stop-loss based on volatility8Ichimoku CloudTrendComplete trend system with signals9Fibonacci RetracementSupport/ResistanceIdentify pullback and entry zones10Volume Indicators (OBV/CMF)VolumeConfirm trends and breakouts

Let’s now explore some of the best ones in detail.

5. 🔍 Deep Dive: Best Indicators Explained

🔹 1. Moving Averages (EMA & SMA)

Simple Moving Average (SMA): averages price over a period.

Exponential Moving Average (EMA): gives more weight to recent prices.

Popular Uses:

50 EMA & 200 EMA crossovers = trend change

Price above 200 EMA = long bias, below = short bias

Use slope of EMA for trend strength

Pro Tip: Use moving average channels for dynamic support/resistance.

🔹 2. Relative Strength Index (RSI)

Ranges from 0 to 100

Above 70 = Overbought (possible sell)

Below 30 = Oversold (possible buy)

How to Use:

Divergence between RSI and price = strong reversal signal

Combine with support/resistance zones

Use RSI > 50 in uptrends, < 50 in downtrends

🔹 3. MACD (Moving Average Convergence Divergence)

Consists of:

MACD line (12 EMA – 26 EMA)

Signal line (9 EMA of MACD)

Histogram (difference between MACD and signal)

Strategy:

MACD line crossing above signal = buy signal

Use MACD divergence to detect early trend reversals

🔹 4. Bollinger Bands

3 lines: Upper, Middle (SMA), Lower band

Bands widen with volatility, contract in calm markets

Trading Ideas:

Price touches lower band + oversold RSI = potential long

Breakout with volume = trend beginning

Range-bound strategy: buy at lower band, sell at upper

🔹 5. ADX (Average Directional Index)

Measures trend strength, not direction

Value > 25 = trend is gaining momentum

Value < 20 = market is ranging

Combine with:

+DI and –DI lines to see bull vs bear strength

Trendline or MA to confirm direction

🔹 6. Stochastic Oscillator

Two lines: %K and %D

Values > 80 = overbought, < 20 = oversold

How to Trade:

Buy when %K crosses above %D in oversold zone

Sell when %K crosses below %D in overbought zone

Best in ranging or corrective phases

🔹 7. ATR (Average True Range)

Measures volatility, not direction

Use for:

Setting realistic stop-losses based on market behavior

Filtering out low-volatility trades

Adjusting position sizing dynamically

🔹 8. Ichimoku Cloud

A complete system: trend, momentum, and future resistance zones

Components:

Kumo Cloud: dynamic S/R

Tenkan & Kijun: short-term trend crossovers

Chikou Span: lagging confirmation

Works best on H4 and D1 timeframes.

🔹 9. Fibonacci Retracement

Tool based on key price ratios (0.382, 0.5, 0.618)

Great for pullback entries in trends

Strategy:

Price retraces to 61.8% + MA support = strong long setup

Combine with candle signals or trendline breaks

🔹 10. Volume Indicators

OBV (On-Balance Volume): volume flow

Chaikin Money Flow: volume + price pressure

Use them to:

Confirm breakouts

Spot early accumulation/distribution

Add strength to RSI/MACD setups

6. 🔗 Best Indicator Combinations

No single indicator is perfect. Here are some powerful combos:

✅ RSI + Bollinger Bands

RSI confirms overbought/oversold

BB shows volatility edge

✅ ADX + Moving Averages

MA shows direction, ADX confirms trend strength

✅ MACD + Volume

MACD gives direction change

Volume confirms if it’s real

✅ Stochastic + Fibonacci

Stochastic entry after Fib retracement level

Always look for confluence of signals before entering a trade.

7. 🧠 Tips for Using Indicators Effectively

Use indicators to confirm, not control decisions

Stick to 2–3 indicators max — don’t clutter your chart

Adjust indicator settings based on timeframe and strategy

Use support/resistance and candlestick patterns as base context

Watch for divergence for early reversal warnings

8. ❌ Common Mistakes to Avoid

Over-reliance on indicators

Using too many conflicting tools

Not backtesting indicators

Ignoring market context

Trading all signals — not all are valid

Remember: Indicators follow price, not the other way around. Context is king.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex factory#forex market#forex education#forex online trading#forex broker#crypto#forex news#forex#forex indicators#forex ea

0 notes

Video

youtube

My 15 Minute Forex Entry Strategy A Sniper Pro Scanner Walkthrough

📈 My 15-Minute Forex Strategy Revealed! 📈

Ever wonder how I find high-probability trade setups? In my latest video, I'm doing a deep dive into my 6-step trading plan using the Jifu Sniper Pro Scanner.

I walk through REAL trade ideas from June 3rd & 4th, showing you:

✅ The 6 specific conditions I look for before entering a trade.

✅ How to use higher time frames for better confirmation.

✅ Why some setups look good but are actually traps to avoid!

✅ A breakdown of a winning trade on GBPUSD.

This isn't about signals; it's about learning a solid, repeatable strategy. If you want to see exactly how it works, let me know!

DISCLAIMER:

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Any opinions, news, research, analyses, prices, or other information contained in this video is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. This content is for educational purposes only. Past performance is not indicative of future results.

0 notes

Text

Proven trading strategies with 80% win rate: Find clarity beyond market chaos

Proven trading strategies with 80% win rate: Find clarity beyond market chaos

Feeling stuck by inconsistent results? Discover proven trading strategies with 80% win rate—designed for traders tired of confusion and ready for clarity, consistency, and reliable profits.

Why 80% Win Rate Matters in Real Trading

Most traders lose money due to random, untested methods. Backtesting shows that proven trading strategies with 80% win rate outperform standard setups by 27%. Consistency isn’t luck—it’s process. Using data-driven systems, you can trade with confidence. Let’s see how these strategies create real, repeatable results.

Simplicity Beats Complexity Every Time

Complex strategies often fail in live markets. A simple, rule-based system—like the 20/50 EMA crossover with strict risk management—has delivered an 80% win rate over the past five years in trending markets. Less noise, more clarity. Simplicity lets you focus and execute without hesitation.

Data-Driven Entries Remove the Guesswork

Entry signals based on confluence—such as RSI levels and volume spikes—raise win rates. For instance, waiting for both EMAs to align with RSI above 50 historically delivers wins 8 out of 10 times. Proven trading strategies with 80% win rate rely on confirmation, not hope. This approach eliminates emotional trading.

Risk Management: The Backbone of Consistency

Even the best strategies fail without strict risk controls. Limiting risk to 1% per trade and using trailing stops keeps losses small and wins consistent. Over 1,000 trades, this discipline produced an 80% win rate while preserving capital. Risk management is your safety net—never trade without it.

Case Study: Turning Frustration Into Consistency

After multiple failed systems, Maria adopted a proven trading strategy with an 80% win rate, focusing on clear rules and discipline. In six months, she doubled her account with minimal drawdown. Her story illustrates that reliable, actionable systems work for real traders, not just theorists.

Simplicity and rules create consistency

Backtested strategies outperform guesswork

Risk management protects every trade

Ready to break free from market chaos? Embrace proven trading strategies with 80% win rate for clear, confident trades. Start your path to consistency now—comment below for your free strategy guide!

What markets work best with an 80% win rate strategy?

These strategies excel in trending markets like forex, major indices, and liquid stocks. Avoid ranging or low-volatility conditions for optimal results.

How much time is needed to implement these strategies?

Most strategies are set-and-forget, requiring just 15–30 minutes daily for setup and review, making them ideal for busy traders seeking efficiency and results.

Have you struggled to find a strategy that actually works? Share your story or reblog—what do you value most in a trading system?

0 notes

Text

7 Forex Market Setups: EUR/USD Trends & Trade Strategies

Market Analysis

GOLD

Gold prices remain consolidated, currently positioned near the EMA200 and the lower boundary of a key consolidation zone. Both MACD and RSI indicators support this consolidation phase. We're waiting for a decisive move to signal the next trend direction. Among the 7 Forex Market Setups this week, gold stands out as a prime example of how geopolitical risk—such as President Trump’s recent tariff threats—can create safe-haven demand. As the market reacts, this setup demands careful monitoring for breakout opportunities. For deeper insights into gold and forex strategies, visit RichSmart FX.

SILVER

Silver continues to show signs of consolidation. Until a definitive breakout or breakdown occurs, we maintain a neutral stance. As part of the 7 Forex Market Setups worth tracking, silver's technical structure reflects hesitation amid broader market uncertainty. This setup is important for traders waiting to catch a momentum shift. See additional silver trade resources from RichSmart.net.

DXY

The U.S. Dollar Index (DXY) is trading sideways, hinting at a potential bearish continuation. Momentum indicators like MACD and RSI suggest further selling pressure may emerge. Within the 7 Forex Market Setups featured this week, the DXY’s indecisiveness mirrors broader uncertainty in USD performance. Its movement is critical in shaping direction across multiple forex pairs. For DXY and USD correlation analysis, explore Axel Private Market.

GBPUSD

GBP/USD finds support at the EMA200, with RSI indicating bullish momentum nearing overbought territory. A minor pullback is possible near the 1.34998 resistance zone. However, MACD suggests sustained bullish momentum. As one of the 7 Forex Market Setups, GBP/USD presents an opportunity aligned with positive sentiment for the Pound. It’s a key chart to watch for continuation or potential reversal signs. Learn more from GFS Markets.

AUDUSD

AUD/USD is bouncing off the 0.64086 support level with growing bullish volume. Momentum indicators are aligned with further upward movement. Included in this week's 7 Forex Market Setups, the Australian Dollar offers a clear trend structure for strategic forex trade planning. Follow up with analysis at DBGMFX.

NZDUSD

NZD/USD shows a strong bullish rejection from recent support levels. MACD confirms increased buying pressure, although the RSI is nearing overbought levels. Among the 7 Forex Market Setups, NZD/USD stands out with its momentum-rich environment, presenting a solid candidate for tactical price action trading. Get NZD insights at TopMax Global.

EURUSD

EUR/USD remains trapped in a consolidation zone, retesting its upper boundary. While MACD hints at bullish momentum, the RSI’s approach toward overbought conditions urges caution. This pair is central to the 7 Forex Market Setups due to its high relevance and potential for breakout. EUR/USD trend analysis remains essential here. For expert perspectives, check WorldQuest FX.

USDJPY

USD/JPY has failed multiple attempts to break above the EMA200, suggesting bearish potential. Despite this, long-term trend structure still supports bullish continuation. As part of the 7 Forex Market Setups, USD/JPY highlights a dual narrative—short-term bearish signals versus longer-term bullish structure.

USDCHF

USD/CHF has weakened following a recent retreat from highs. Prices are consolidating under resistance, with bearish signals from MACD and RSI. Included in the 7 Forex Market Setups, USD/CHF shows potential for further decline, pending confirmation through key support levels.

USDCAD

USD/CAD continues to slide as CAD strengthens, driven by a strong Q1 2025 GDP report (2.2% annualized) and reduced likelihood of an immediate rate cut by the BoC. This pair rounds out the 7 Forex Market Setups, offering a bearish bias that aligns with current macroeconomic fundamentals favoring the Canadian dollar.

COT Market Analysis

AUD - WEAK (5/5)

GBP - STRONG (5/5)

CAD - WEAK (5/5)

EUR - STRONG (3/5)

JPY - STRONG (3/5)

CHF - WEAK (4/5)

USD - MIXED

NZD - WEAK (4/5)

GOLD - STRONG (3/5)

SILVER - STRONG (5/5)

Final Thoughts

This week’s 7 Forex Market Setups showcase a range of opportunities across metals and major currency pairs. Strategic forex trade planning and consistent application of price action trading remain critical, especially with EUR/USD and related setups in consolidation or reversal zones. As geopolitical and economic developments evolve, being selective and disciplined in execution will help traders capitalize on the most favorable market conditions.

0 notes

Text

Key Components of the Trader's Dynamic Index Indicator

The TDI consists of three essential components that function as a system to display market activity.

RSI (Relative Strength Index):

The indicator evaluates price speed alongside movement changes to detect market conditions of overbought and oversold states.

If it goes too high or too low, very fast, it helps the traders to analyze when the price might reverse.

Moving Averages (Signal Line & Market Base Line):

The moving averages smooth the RSI while enabling traders to determine trend direction and strength.

This makes it easier for traders to understand that if the market is going up, down or staying flat in a very easy way.

Volatility Bands (Bollinger Bands):

Market movements are best expressed through these indicators to detect breakouts. This helps traders to analyse when the price might move quickly in one direction.

Through this combined methodology, traders can view the entire price activity from one consolidated platform. TDI functions as a complete trading system because it exists within a single indicator.

TDI Technical Analysis: How to Interpret the Signals

For the first time, one might find Traders Dynamic Index tricky, but once you understand the signals, it becomes a powerful tool for decision making. It helps you understand what the market is doing. It shows if the price is strong, weak, or going sideways which helps with when to buy, sell, or stay out of the market.

The green line is the main one to focus on, it shows direction and strength of the market. When it moves upward sharply, that usually means start buying. If it goes down it means selling pressure is high. A flat green line usually means the market is stable.

The red line works in parallel with the green line. When green crosses and moves past the red line, that’s the signal to buy. When it goes below the red line, that’s your clue to sell. The yellow line shows the overall trend.

If both the red and green lines are above the yellow line this supports the buy setup, vice versa if these are below yellow line, that points sell setup.

The blue band shows how active the market is. Wide bands mean more movement and possible breakouts. Tight bands suggest low activity.

0 notes

Text

Why Automation Matters in Modern Forex Trading Software

Buying and selling various currencies in order to profit is known as forex trading. It is among the world's biggest markets. People all over the world trade every day to earn profits. But now, trading has changed a lot because of automation.

Automation means letting software do things for you without needing to do it by hand. In forex trading, it helps traders place trades, manage their money, and follow their plans without doing everything manually.

Let’s look at why automation is so helpful in today’s forex trading.

1. Trades Happen Faster

Currency prices change very quickly, every second. If you are too slow to place a trade, you can lose money. Manual trading takes time because the trader has to watch the screen and click buttons.

Automated software makes trades instantly. It reacts fast and does not waste time. This gives traders a better chance to earn profits, especially when the market moves quickly.

2. Fewer Mistakes

People can make mistakes, especially when tired or emotional. A trader might click the wrong button or type the wrong number.

Automation avoids these problems. Once you set up your trading plan, the software will follow it exactly. It doesn’t get tired or emotional. This keeps your trading more accurate and safe.

3. Trade All Day and Night

The forex market is open 24 hours a day, five days a week. But people can’t stay awake and trade all the time. That means traders might miss good chances when they are asleep or busy.

Automated software doesn’t need sleep. It can watch the market and make trades all day and night. This way, you never miss a good opportunity.

4. Test Your Strategy First

Before using a trading strategy with real money, it’s smart to test it. This is called backtesting. You check how your strategy would have worked in the past.

Modern trading software lets you test your ideas using old market data. If the test shows good results, you can use the strategy with more confidence.

5. Better Control Over Losses

Good trading is not just about making profits. It’s also about protecting yourself from losses. Automation helps by using tools like stop-loss and take-profit.

If a trade goes bad, the software closes it at the loss limit you set. If the trade goes well, it takes the profit at the level you chose. This helps you control risk and avoid emotional decisions.

6. Always Follow the Plan

Many traders make a good plan but don’t follow it. They change their mind out of fear or greed. This usually causes problems.

Automated software follows the plan without changing it. It doesn’t feel like anything. It just does what it’s told. This helps traders stick to their plan and trade more wisely.

7. Watch Many Markets at Once

Watching several currency pairs at the same time is hard for one person. A trader can miss important signals if they are focused on just one chart.

Automated software can look at many pairs at the same time. It scans the market quickly and finds good trades wherever they happen. This helps traders find more chances without missing out.

8. Saves Your Time

Manual trading takes a lot of time. You have to sit in front of the screen for hours and watch charts, read news, and make trades. It can be tiring.

With automation, you set your strategy once and the software does the work. You don’t have to watch everything all day. You can use that time for other things while the software keeps trading for you.

9. Helps You Stay Disciplined

Discipline is very important in trading. Many traders lose because they can’t control their emotions or follow their own rules.

Automation removes emotions from trading. Once you set the rules, the software follows them. This helps you stay disciplined and avoid bad choices.

10. Easier to Grow Your Trading

With automation, you can do more. You can trade many strategies or currency pairs at the same time. You don’t need to do extra work.

As you get better at trading, you can improve your software and grow your system. This helps you build a stronger trading plan over time.

Final Thoughts

Today, automation is very important in forex trading software development. It helps traders make faster trades, avoid mistakes, control losses, and save time. It also helps them stay calm and follow their plan.

Whether you are new to forex or have experience, automation can make your trading better. It gives you more control and helps you grow. If you want to trade smarter and with less stress, using automation is a great choice.

0 notes

Text

How to Choose the Right Broker for Online Trading

Online trading has become one of the most popular ways to invest and grow wealth today. Whether you're a complete beginner or someone with some experience, choosing the right broker is one of the most important decisions you'll make on your trading journey. The broker you select can influence everything from the ease of placing trades to the quality of the research and tools available. But with so many options out there, how do you pick the one that suits your needs best? This article will walk you through the essential factors to consider when choosing a broker, and why Alpha Trend Capital stands out as a trusted name in the industry.

When you first start looking for a broker, you might feel overwhelmed by all the choices. Some brokers advertise low fees, others highlight powerful trading platforms, while some focus on providing exceptional customer service. The truth is, there isn’t a one-size-fits-all answer. What works best for one trader might not work for another. The key is to understand your own trading style and goals, then find a broker that aligns with those.

One of the very first things to check is the broker’s reputation and regulation status. It’s crucial to work with a broker that is licensed by respected financial authorities. This ensures your money is protected and that the broker operates under strict standards. Alpha Trend Capital, for example, is known for its transparency and regulatory compliance, making it a safe choice for both new and experienced traders.

Next, consider the range of assets the broker offers. Are you interested in stocks, forex, cryptocurrencies, or commodities? Not all brokers provide access to every market, so make sure the broker you choose offers the assets you want to trade. alpha Trend Capital offers a broad range of investment options, allowing traders to diversify their portfolios without having to open multiple accounts with different providers.

Fees and commissions are another vital factor. While low costs are attractive, sometimes extremely low fees can mean fewer features or less reliable service. It’s important to find a broker that offers competitive pricing but also delivers value through quality execution and support. Alpha Trend Capital strikes this balance well by offering reasonable spreads and transparent fees, which helps traders keep more of their profits.

Trading platforms and tools are where many traders spend a lot of their time, so the usability and reliability of the broker’s technology matter a great deal. Some brokers offer complex platforms with advanced charting and analysis tools, while others keep it simple for beginners. Alpha Trend Capital provides a robust yet user-friendly platform that suits traders of all experience levels. The platform includes real-time data, customizable charts, and educational resources that help traders make informed decisions.

Customer support is often overlooked but can make a big difference, especially when you encounter technical issues or have questions about your account. Good brokers offer responsive support via multiple channels such as live chat, phone, or email. Alpha Trend Capital is praised for its attentive customer service team that is available to assist traders whenever they need help.

Security is another non-negotiable factor. Online trading involves handling sensitive financial data, so the broker must have strong security measures in place. Look for brokers that use encryption, two-factor authentication, and secure payment methods. Alpha Trend Capital takes security seriously and implements industry-standard protections to keep your data and funds safe.

For traders who want to sharpen their skills and knowledge, educational resources and research tools are invaluable. A broker that provides webinars, tutorials, market analysis, and trading signals can greatly enhance your learning curve. Alpha Trend Capital offers an extensive library of educational content designed to help traders grow and succeed over time.

Finally, think about the minimum deposit and account types offered. Some brokers require a hefty initial deposit, which might not be ideal if you're just starting out. Alpha Trend Capital has flexible account options that cater to both beginners and professional traders, making it easier for anyone to start trading without a large upfront commitment.

In conclusion, choosing the right broker is more than just picking the one with the lowest fees or the flashiest platform. It’s about finding a partner that supports your trading goals, provides reliable service, and prioritizes your security. Alpha Trend Capital stands out in the crowded market for these reasons, making it a top choice for traders looking for a trustworthy and comprehensive online trading experience. Take your time, do your research, and pick a broker that fits your unique needs — your trading success depends on it.

0 notes

Text

About Course: This course is a concise yet comprehensive introduction to advanced forex trading concepts, curated by WillStreet_fx. Through a structured series of 12 videos, the course walks traders from foundational elements to advanced market strategies, focusing on technical precision and strategic timing. Course Modules: Introduction – Overview of the trading approach and course structure. Timeframes and Candles – Understanding how to read and interpret market movements using timeframes and candlestick analysis. SMT (Smart Money Technique) – Identifying divergence using correlated instruments for more accurate signals. Bias – Developing directional bias and its role in filtering trades. Entries – Structuring high-probability trade entries. Failure Swing – Recognizing market traps and failed structure swings. NWOG & NDOG – A breakdown of New Week Opening Gaps and Daily Opening Gaps and their trading implications. London Model – Specific strategies for trading during the London session. New York Model – Key setups and behavior in the New York session. Red Flags – Common mistakes and warning signs to avoid in trades. News Trading – Navigating economic releases and market volatility. Risk Management – Practical approaches to preserving capital and ensuring long-term consistency.

0 notes

Text

Which Forex Signal Is Most Accurate?

The short answer is — there is no one-size-fits-all solution. But the signals can provide around 99% accuracy if backed by only expert analysis and research.

So, there’s no universally “most accurate” forex signal, but the best ones are:

Transparent

Verified

Consistent

Risk-conscious

Choose wisely, and remember — a signal is only as good as how you manage your risk and strategy around it.

What Makes a Forex Signal “Accurate”?

Accuracy in forex signals depends on several factors:

Win rate consistency (typically 60%–75% is considered reliable)

Risk-reward ratio

Transparency of past performance

Real-time execution and low lag

Source credibility

Signals can be manual (from experienced traders) or algorithmic (from automated trading bots). Both have pros and cons, and many traders choose hybrid services offering both.

A study by FXCM (2023) noted that profitable traders used signals with an average win rate of 63% and followed risk management practices like 1:2 risk-reward ratios.

In another analysis by Myfxbook, signal providers with long-term consistency (over 12 months of verified performance) showed average monthly returns of 3%–7%, while those with high short-term gains often collapsed within 3–6 months

To find the Most Accurate Fx Signals- Trust the Process, Not the Hype

Many experienced traders on forums like Forex Factory and Reddit's r/Forex emphasize:

Avoid “get-rich-quick” signal providers

Look for transparency (e.g., shared verified Myfxbook stats)

Signals backed by real-time analytics, not just predictions

Services that offer education + signals (like 1000pip Builder or Learn 2 Trade) are more trusted

#forex#forexsignals#forex trading#forex signals#forextrading#forex trading tips#forex signal service#best forex signals#best forex signal#accurate forex signal

0 notes

Video

youtube

Golden Era Scanner in Action Finding High Probability Forex Trades Live ...

Mastering the Golden Era Forex Scanner: Step-by-Step Trade Example (Focuses on learning)In this detailed video I show the Golden Era Scanner in a live Forex trading scenario (after the fact)! Watch step-by-step how to identify potential trade setups, understand confirmation signals, and manage your trades using this powerful tool.In this video, you'll learn:How to spot the initial checkmark confirmation on the Golden Era Scanner.The importance of waiting for candle closes before making decisions.Identifying the "Golden Zone" and strategic entry points (including the halfway point strategy for better risk/reward).How to set your stop-loss and target profits using Exit 1 and Exit 2.Understanding the "white flag" indicator and what it means for your trade.Key additional confirmations to look for: trading with the trend, bullish/bearish engulfing candles, and market imbalance.Real-world application and analysis of a live trade example.Whether you're new to Forex trading or looking to enhance your strategy, this Golden Era Scanner demonstration provides valuable insights and practical tips. FREE GOLDEN ERA SCANNER OVERVIEW PDF:Learn more about the scanner and its features! Download your free PDF guide here:https://sorianoblueprint.com/GOLDEN-ERA-SCANNER-OVERVIEW.pdf EXCLUSIVE $50 JIFU BONUS OFFER! Interested in a $50 bonus? Contact Bill to learn how you can qualify when you join Jifu! This is a limited-time offer, so don't miss out!

0 notes

Text

World's Most Successful Trader: A Proven System for Frustrated Traders

World's Most Successful Trader: A Proven System for Frustrated Traders

Ever wondered how the world's most successful trader consistently outperforms the market? Discover the data-driven system that turns chaos into clarity and helps experienced traders regain control.

The Power of Simplicity in Trading

The world's most successful trader doesn’t rely on convoluted indicators. Instead, they use a simple, repeatable process. A recent study showed that traders who simplify their strategies improve consistency by 64%. Simplicity removes noise, letting you focus on what actually matters. This shift is the first step to regaining your edge.

Historical Performance: The Ultimate Proof

Proven systems stand the test of time. The world's most successful trader’s approach delivered over 18% annual returns for two decades (source: Barron's). By following a data-backed method, you sidestep emotional decisions. Historical performance offers the reliability traders crave, especially after repeated setbacks.

Actionable Signals: No Guesswork

Forget speculation. The world's most successful trader uses rules-based signals—buy, sell, hold—based on quantifiable data. For example, a moving average crossover strategy outperformed the S&P 500 in 9 of the last 12 years. Clear rules mean consistent action, not second-guessing.

Risk Management: The Secret Weapon

Even the world's most successful trader faces losses, but robust risk management keeps setbacks small. Studies show that disciplined stop-loss strategies cut drawdowns by 50%. This approach means you never risk blowing up your account, giving you confidence to trade through volatility.

Your Next Step: Implement the Formula

Ready to break free from frustration? Model your approach on the world's most successful trader. Start by simplifying, backtesting, and committing to a rules-based plan. Consistency is possible—if you follow a system built on proven principles.

Simple systems outperform complex ones over time.

Rules-based signals reduce emotional mistakes.

Strict risk management protects your capital.

Stop chasing hype. Instead, follow the world's most successful trader’s formula to thrive in any market. Ready to reclaim your consistency? Start applying proven principles today.

FAQ: How do I find a reliable trading system?

Focus on systems with transparent rules, backtested results, and long-term performance data. Avoid anything promising overnight riches. The world's most successful trader uses time-tested, simple methods.

FAQ: Can I adapt these methods to any market?

Yes. The principles used by the world's most successful trader—simplicity, historical proof, and risk management—work across stocks, forex, and crypto. Adjust your parameters, but keep the core rules intact.

What trading frustrations have you faced? Comment or reblog if you’re ready for a system that delivers. Which part of the world's most successful trader’s approach would help you most?

0 notes